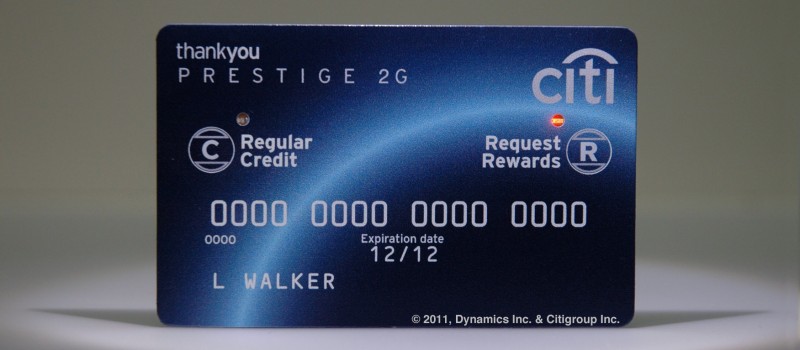

I’ve been continually impressed with the ways that Citi has been making their rewards points accessible and redeemable. Over the year’s I’ve talked about programs such as their dual-mode credit card, which allows redemption of some points at the push of a button, as well as the Shop With Points feature on Amazon, which lets users redeem points for part or all of a purchase. Now comes their latest innovation: Rewards Accounts Numbers, which takes the entire process a step further. Continue reading