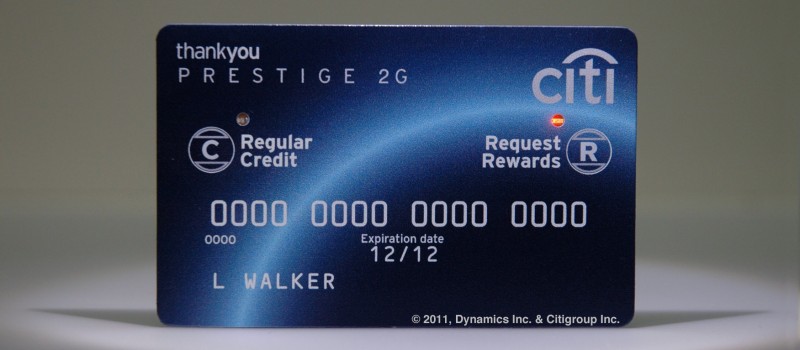

I’ve been continually impressed with the ways that Citi has been making their rewards points accessible and redeemable. Over the year’s I’ve talked about programs such as their dual-mode credit card, which allows redemption of some points at the push of a button, as well as the Shop With Points feature on Amazon, which lets users redeem points for part or all of a purchase. Now comes their latest innovation: Rewards Accounts Numbers, which takes the entire process a step further.

One-time use card numbers have become increasingly available for people who wish to shop online but not use a consistent card number (to reduce the risk of fraud or card number theft). Using the same sort of technology, Citi will now issue those who have the Rewards Account Numbers feature a number that can be used only on the day it’s issued, but transactions processed with it will trigger statement credits purchased with points. A cap can be set as to the number of points that can be used by the feature, if you only wish to use a certain number for the transaction.

The major downside to this method is that the conversation rates are unfavorable compared to other methods. Whereas most gift cards are roughly 100 points per dollar, and Amazon appears to be around 125 points per dollar, the statement credit model (assuming it uses the standard rates listed as thankyou.com; it’s not entirely clear in their marketing materials) converts at 200 points per dollar, which is a considerable dilution of point value relative to other redeemable options. That said, having the flexibility to spend the points anywhere is a plus, similar to how the premium for using points at Amazon is offset by the enormous selection.

At the very least, it’s nice to see rewards cards become ever more flexible, and in this arena, Citi continues to be clever and creative with how that happens. Hopefully others will follow their lead.