With the year drawing to a close, thoughts turn to the new year, and inevitably, new year’s resolutions. I’m not particularly fond of them; I think it’s an arbitrary date that doesn’t spur on real change, but temporary motivation (I’m for sure in that camp). That said, I’m never going to argue against things that encourage good habits, as long as people stay focused, so if it works for others, fantastic. One such resolution, which seems to be getting passed around each year around this time, is the 52-week money challenge.

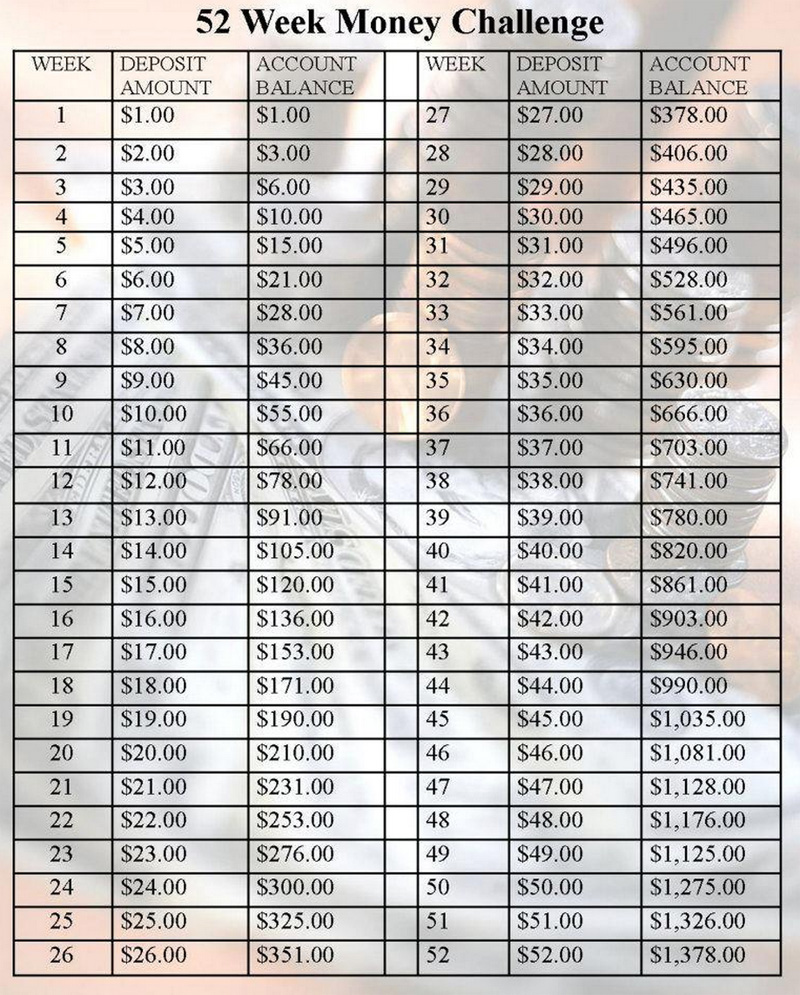

The idea is simple enough: Start with $1 the first week, and each week add $1 to the amount you save for that week (so for week 2, $2; for week 3, $3, and so on). At the end you should end up with very near close to $1500. That isn’t too bad for a year of saving, although it’s just a starting point, of course. Here’s the full table that’s commonly seen on Facebook:

What I’d love is to hear from people who attempted this and share their results. I’d also love to see a year two variant of this: Now that you’re successfully putting a bit more than $50 aside a week, do that each week for a year. So in year two, save $52 a week. In year two you’ll save exactly double: $2,704. Assuming you were successful in not touching year one’s savings, you’ll now have just over $4,000. And then keep going from there.

The idea behind saving is that once you’re regularly setting money aside, you’ll adapt to not needing the money. Then, when something like a pay raise comes along, you can set part of the raise aside for savings, and part of it can become part of your budget. The norm is to set 1% more of your income aside each year until you’re saving somewhere between 10 and 15% of your income, so you can start working toward a retirement. But the 52 Week Money Challenge, as a way to encourage people to set aside money for things like an emergency fund, is at least a helpful way to kick things off.